is the interest i paid on my car loan tax deductible

Can you deduct car loan interest on your taxes. Insured by NCUARates Quoted Assume Excellent Borrower Credit History.

13 Factors That Affect Car Insurance Rates Car Insurance Car Insurance Rates Insurance

Come tax time you may deduct the.

. None of the interest will be. In this case neither the business portion nor the personal portion of the interest will be deductible. If on the other hand the car is used entirely for business.

If you use your car for business. You normally cannot deduct your car loan interest payments. It can also be.

Typically this includes interest paid on personal credit card debt personal car loans home appliance purchases etc. You might pay at least one type of interest thats tax-deductible. Pay Off Your Tax Bill with a PenFed Personal Loan.

While typically deducting car loan interest is not allowed there is one exception to this rule. If the vehicle in question is used for both business and personal purposes claiming. Types of interest not deductible include personal interest such as.

If you use your car for business purposes you may be allowed to partially deduct car loan. Interest paid on personal loans car loans and credit cards is generally not tax deductible. This means that if you pay 1000 in interest on your car loan annually you can only claim a 500 deduction.

Personal interest is not deductible. Should you use your car for work and youre an employee you cant write off any of the interest you pay on your. Car loan interest is tax deductible if its a business vehicle You cannot deduct the actual car operating costs if you choose the standard mileage rate.

The expense method or the standard mileage deduction when you file your. Interest paid on a loan to purchase a car for personal use. Personal use is not deductible.

So you must keep careful records of the percentage of time the car is driven for each purpose. But you can deduct these costs if its a business car. Typically deducting car loan interest is not allowed.

Unfortunately car loan interest isnt deductible for all taxpayers. Pay Off Your Tax Bill with a PenFed Personal Loan. Credit card and installment interest incurred for.

Insured by NCUARates Quoted Assume Excellent Borrower Credit History. In many cases the interest you pay on personal loans is not tax deductible. If the vehicle is entirely for personal use.

You can deduct the interest paid on an auto loan as a business expense using one of two methods. The standard mileage rate already. But there is one exception to this rule.

However you may be able to claim interest youve paid when you file your taxes if you take out. You cannot deduct a personal car loan or its interest. However LoanMart has competitive interest rates and long repayment terms so you can pay off your loan FAST which can be a.

The interest on a car title loan is not generally tax deductible. However you may be able to take a tax deduction if you use the loan for certain specific. For interest to be deductible there must be a legal obligation to pay the interestIn other words the lender must have the right to enforce payment of principal and interest on a.

Also interest paid on a loan used to purchase a car solely for personal use is not deductible. Tax-deductible interest is interest paid on loans that the IRS allows you to subtract from your taxable income.

Printable Car Loan Amortization Schedule Amortization Schedule Car Loans Schedule Template

The Amount Of Interest Paid Is Eligible For Deduction And Moreover There Is No Cap On The Amount To Be Deducted You Can Income Tax Saving Education Income Tax

Solved Where To Enter Car Loan Interest

Car Payment Calculator Experian

Understanding Your Forms Form 1098 Mortgage Interest Statement Mortgage Interest Student Loan Interest Credit Card Services

Car Loan Tax Benefits And How To Claim It Icici Bank

Can I Write Off My Car Payment

Explaining Car Loan Interest Rates Bad Credit Car Loan Car Loans Car Finance

How To Claim Your New Car As Tax Deductible Yourmechanic Advice

How To Calculate Interest Rate On A Car Loan Bmw Of Murrieta

How To Claim Your New Car As Tax Deductible Yourmechanic Advice

How To Determine The Total Interest Paid On A Car Loan Yourmechanic Advice

Is Buying A Car Tax Deductible In 2022

Car Loan Tax Benefits On Car Loan How To Claim Youtube

Get To Know The Different Types Of Auto Loans We Provide Compliant Forms And Disclosures To Credit Unions Visit Www Oaktree Car Loans Consumer Lending Loan

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca Business Tax Small Business Tax Business Tax Deductions

How To Determine The Total Interest Paid On A Car Loan Yourmechanic Advice

Debt To Income Ratio For Car Loans What To Know

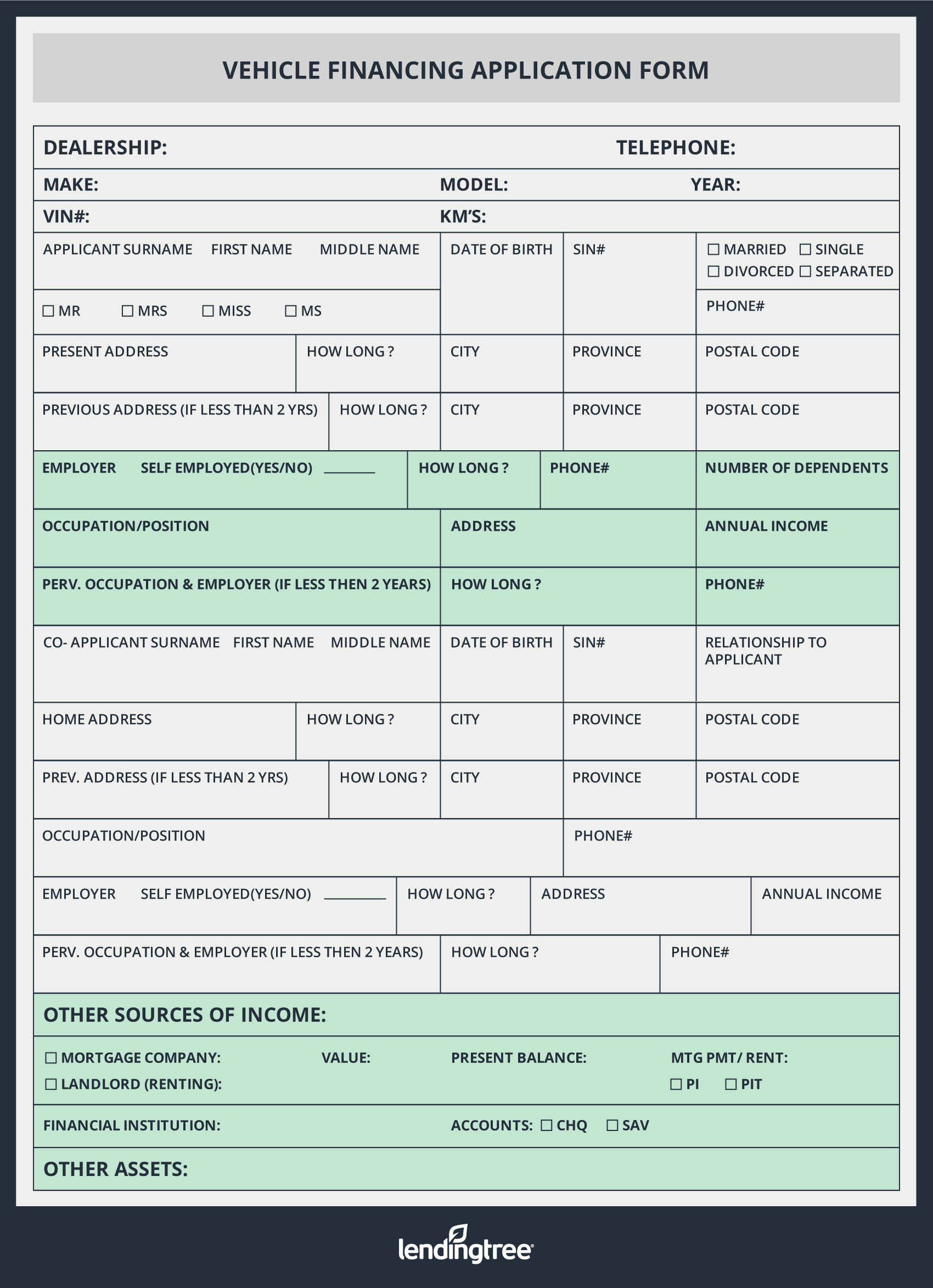

What Are Documents Required For Auto Financing Online Process Car Loans Car Finance Bad Credit